FPT Business Overview

Frasers Property (Thailand) Public Company Limited (“the Company”), formerly known as TICON Industrial Connection PCL (“TICON”) was established in 1990 and listed on the Stock Exchange of Thailand in 2002. The Company engages in the development and management of industrial properties for ready-built factory and ready-built warehouse located inside and outside industrial estate. Subsequent to the major flood in 2011, the Company had made a strategic shift of its portfolio following the relocation of manufacturing base from the Northern and Central region to the new area, with its business strategy to maintain occupancy rate and tenant base. After Frasers Property Group has become its major shareholder, the Company pursued more development initiatives in Built-to-Suit industrial property to strengthen and enhance its capability to compete in the long run.

In 2019, the Company was officially rebranded to "Frasers Property (Thailand) PLC" and traded on the Stock Exchange of Thailand under a new trading ticker "FPT", with commencement of a new business platform under the global brand "Frasers Property". The Company is now a member of Frasers Property Limited, a multi-national company listed on the Singapore Stock Exchange that owns, develops, and manages a diversified portfolio in 5 real estate asset classes including serviced apartment and hospitality, residential, commercial and business park, retail, and industrial properties across Singapore, Australia, Europe, China, and Southeast Asia. Underlying the strategic direction of the Group Company, the Company made an announcement to acquire the business of Golden Land Property Development Public Company Limited (“GOLD”) The rationale and benefits of this transaction were to expand the business of the Company into a quality platform in residential, commercial and hospitality property sectors and become the 1st fully integrated real estate platform in Thailand.

During 2020, the Company moved its headquarter to Mitrtown Office Tower and announced the success of organizational integration with GOLD, an important step to become one of Thailand’s top real estate developers. Currently, the operations have been fully integrated under the One Platform strategy with One culture and One unifying corporate purpose, ‘Inspiring Experiences, Creating Places for Good’ to guide a business direction towards sustainability and resilience, while undertaking a transformation to strengthen its operation and reconfigure the work approach to address evolving customer behaviors.

Underlying the strategic direction, the Company integrates multi-asset class development and management capabilities with an aim to solidify business foundation for promoting the next level of growth platform. With a balance and diversified portfolio further enhancing income resilience, the Company strives to deliver long-term value for a sustainable return, while leveraging on investment and partnership as well as embracing innovation and technology to enhance competitiveness across all dimensions. By creating a future-ready business and solution well-served to the dynamic needs of the real estate sector, the Company adheres to a principle of good corporate governance for the benefits of customers, communities, societies, and environment.

Overall company structure comprises 3 businesses as follows:

- Residential Property Business

- Commercial Property Business

- Industrial Property Business

Revenue Structure

For the fiscal year 2024 (1 October 2023 – 30 September 2024), the Company’s revenue structure was contributed from sales of residential real estate, gain on sales of industrial properties as well as rental and related services revenue from industrial and commercial property.

| Consolidated Financial Statements | ||||||

|---|---|---|---|---|---|---|

| 2022 | 2023 | 2024 | ||||

| Amount | % | Amount | % | Amount | % | |

| Revenue from sales of real estate | 11,420,442 | 69.86 | 11,003,711 | 65.46 | 9,173,559 | 62.98 |

| Revenue from rental and related services | 2,391,918 | 14.63 | 2,799,007 | 16.65 | 3,130,774 | 21.49 |

| Revenue from hotel business | 329,162 | 2.01 | 566,902 | 3.37 | 430,155 | 2.95 |

| Management fee income | 711,744 | 4.35 | 714,652 | 4.25 | 729,312 | 5.01 |

| Investment income | 60,097 | 0.37 | 80,998 | 0.48 | 70,503 | 0.48 |

| Gain on capital redemption of investment in associates | 381,080 | 2.33 | - | - | - | - |

| Gain on sales on investment in subsidiaries | - | - | 482,291 | 2.87 | - | - |

| Gain on sales on investment in joint venture | 179,267 | 1.23 | ||||

| Gain on sales of investment properties | 869,117 | 5.32 | 1,028,776 | 6.12 | 720,398 | 4.95 |

| Other income | 183,056 | 1.12 | 133,137 | 0.79 | 132,444 | 0.91 |

| Total Revenue | 16,346,616 | 100 | 16,809,474 | 100 | 14,566,412 | 100 |

Residential Property Business

The Company and its subsidiaries engage in the real estate development business that offers a wide range of residential products, brands, and development of infrastructure within the project. The products include single-detached houses, semi-detached houses, townhomes, and condominium in various price ranges under different brands to cover diverse market segments and different clienteles.

The product brands for the Company and its Group are:

| Product Type | Brand | Price Range |

|---|---|---|

| Single-detached house |

|

More than 60 MB |

|

20 - 40 MB | |

|

6 - 20 MB | |

| Semi-detached house |

|

4 - 7 MB |

| 2-3 Story Townhome |

|

3 - 6 MB |

| 2 Story Townhome |

|

2 - 4 MB |

| Condominium |

|

3 - 5 MB |

As of 30 September 2024, there were 75 active projects with total project value of THB 104,935 million. The project details categorized by brand and type of product are as follows:

| Brand | No. of Project | Project Detail | Sales | Transfer | Remaining | ||||

|---|---|---|---|---|---|---|---|---|---|

| No. of Units | Project Value (MB) | No. of Units | Project Value (MB) | No. of Units | Project Value (MB) | No. of Units | Project Value (MB) | ||

| Golden Town | 30 | 10,359 | 31,126 | 7,281 | 22,963 | 5,892 | 17,469 | 4,386 | 13,386 |

| Golden City | 1 | 167 | 718 | 261 | 1,369 | 153 | 643 | 10 | 54 |

| Total Townhome Projects | 31 | 10,526 | 31,844 | 7,542 | 24,332 | 6,045 | 18,112 | 4,396 | 13,440 |

| Golden Neo | 11 | 2,792 | 14,326 | 1,604 | 7,879 | 1,792 | 8,427 | 979 | 5,769 |

| Neo Home | 6 | 913 | 4,985 | 264 | 1,414 | 354 | 1,843 | 547 | 3,082 |

| Total Semi-detached House Projects | 17 | 3,705 | 19,311 | 1,868 | 9,293 | 2,146 | 10,270 | 1,526 | 8,851 |

| The Royal Residence | 1 | 31 | 3,343 | 49 | 3,053 | 3 | 203 | 28 | 3,140 |

| The Grand & Alpina | 7 | 607 | 15,218 | 168 | 5,308 | 399 | 8,233 | 204 | 6,849 |

| Grandio | 13 | 2,349 | 27,746 | 897 | 10,503 | 1,094 | 12,063 | 1,233 | 15,368 |

| Prestige | 4 | 873 | 6,566 | 181 | 1,375 | 234 | 1,673 | 636 | 4,875 |

| Golden Village | 1 | 99 | 464 | 78 | 377 | 77 | 364 | 21 | 96 |

| Total Single-detached House Projects | 26 | 3,959 | 53,337 | 1,373 | 20,616 | 1,807 | 22,536 | 2,122 | 30,328 |

| Klos | 1 | 111 | 443 | 22 | 81 | 0 | 0 | 89 | 362 |

| Total Condominium Project | 1 | 111 | 443 | 22 | 81 | 0 | 0 | 89 | 362 |

| Grand Total | 75 | 18,301 | 104,935 | 10,805 | 54,322 | 9,998 | 50,918 | 8,133 | 52,981 |

2024 Residential Project Development Plan

In 2024, the Company launched 6 new residential projects with total project value of THB 9,442 million, categorized by product type as follows:

Single-detached house - 5 Projects

Condominium - 1 Project

The details of launched projects in 2024:

1. Grandio Chaengwattana-Muang Thong

Pre-sale Date : 25-26 November 2023

Product Type : 2-story Single-detached house

No. of Units : 140 Units

Project Value : THB 2,223 million

2. The Grand Chaengwattana-Muang Thong

Pre-sale Date : 2-3 March 2024

Product Type : 2-story Single-detached house

No. of Units : 60 Units

Project Value : THB 2,119 million

3. The Grand Pinklao - Kanchana

Pre-sale Date : 25-26 May 2024

Product Type : 2-story Single-detached house

No. of Units : 39 Units

Project Value : THB 1,650 million

4. Grandio Kaset-Nawamin

Pre-sale Date : 17-18 May 2024

Product Type : 2-story Single-detached house

No. of Units : 117 Units

Project Value : THB 2,100 million

5. Neo Home Rayong

Pre-sale Date : 8-9 June 2024

Product Type : 2-story Single-detached house and Semi-detached house

No. of Units : 177 Units

Project Value : THB 900 million

6. Klos Ratchada7

Pre-sale Date : 8-9 June 2024

Product Type : 8-story Condominium

No. of Units : 111 Units

Project Value : THB 450 million

Market and Competition

Industry Overview

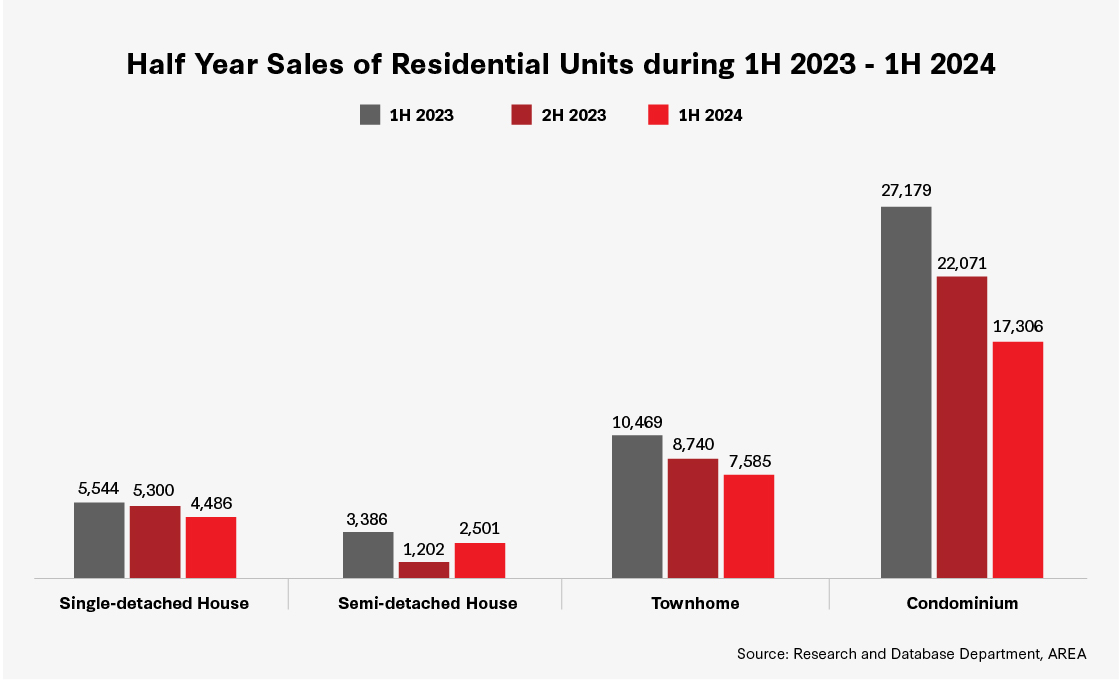

Overall residential sales in Bangkok and its vicinity in the first half of 2024, the residential units sold saw a 31% decrease or down by 14,610 units, when compared with the same period of previous year.

The details of residential unit sold in the first half of 2024 were as follows:

- Single-detached house: 4,486 units, a decrease of 19% Y-o-Y

- Semi-detached house: 2,591 units, a decrease of 23% Y-o-Y

- Townhome: 7,585 units, a decrease of 28% Y-o-Y

- Condominium: 17,306 units, a decrease of 36% Y-o-Y.

The number of residential units sold in six-month period from the first half of 2023 to the first half of 20234 categorized by product, were shown in the following chart:

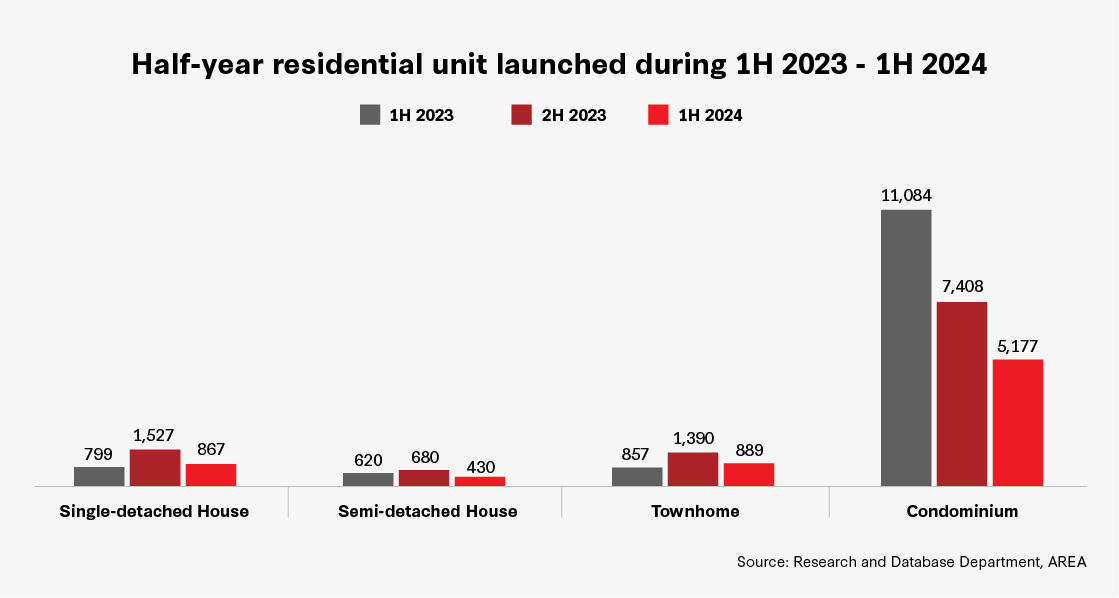

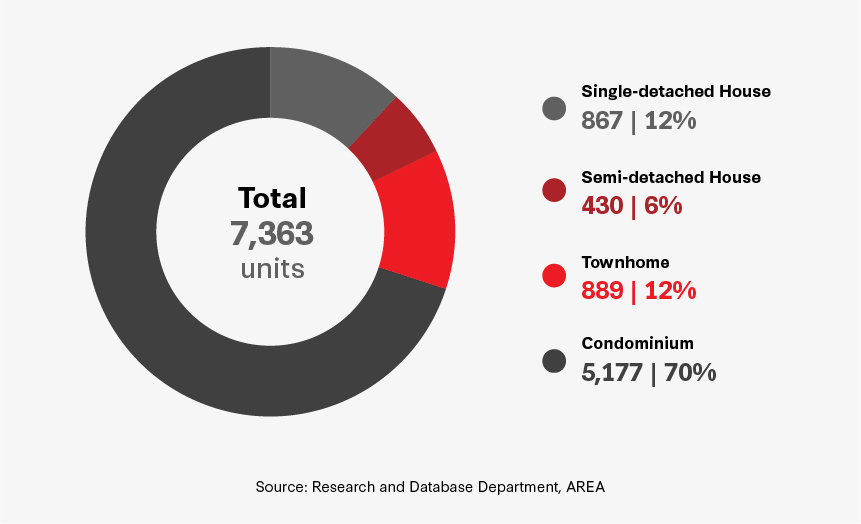

Considering the figures of newly launched residential units, 7,363 units were launched in the first half of 2024, a decrease of 45%, comparing to the first half of 2023.

The details of residential unit launched in the first half of 2024 were as follows:

- Single-detached house: 867 units, an increase of 8% Y-o-Y

- Semi-detached house: 430 units, a decrease of 31% Y-o-Y

- Townhome: 889 units, an increase of 4% Y-o-Y

- Condominium: 5,177 units, a decrease of 53% Y-o-Y.

The number of residential units launched in six-month period from the first half of 2023 to the first half of 2024, categorized by product, were shown in the following chart

In comparison with the new residential units launched in the first half of 2024, condominiums had the most new units launched, with 5,177 units. Next were townhomes with 889 units, followed closely by single-detached houses at 867 units, and semi-detached houses with 430 units.

Business Strategy

As competition in residential market has been intensified with many veteran key players, together with customer exercising more rationale in making a home purchase decision, the Company sets forth key strategies to stay competitive as follows:

- Product Strategy

The Company is dedicated to delivering high-quality products with exceptional design and comprehensive living functionality, tailored to meet the diverse needs and lifestyles of families across all segments. Through its diverse range of brands, the Company offers products that span various price points and housing types, from single-detached houses and semi-detached houses to townhomes, ensuring comprehensive solutions for all customer groups. In 2024, the Company has broadened the portfolio with the launch of its first condominium project under the 'Klos' brand, marking a strategic milestone in expanding its presence into a new market segment.

To support sustainable living, the Company has integrated cutting-edge technology and innovation into its design and construction processes. Acknowledging the critical importance of clean energy, the Company has equipped its projects with electric vehicle (EV) charging stations and solar panels. By next year, we aim to install solar panels across clubhouses and show units in 71 projects, generating over 1,470 kilowatts of electricity, equivalent to planting 100,000 trees.

With a commitment to creating products that align with current market demands and sustainability goals, the Company will continue to develop solutions that not only offer high quality and innovative design but are also environmentally responsible, further solidifying its leadership in Thailand's residential market.

- Location Strategy

The Company pays attention to site selection and chooses its sites according to selection criteria and customer’s varying needs by segment. There are 4 main criteria for location strategy as follows:

- Accessibility Choosing a location that is conveniently accessible in line with market demand.

- Community Acquiring land in the urban city or close to community area, though with the higher land prices yet a strong demand.

- Near Facility Locating near facilities such as markets and malls. Furthermore, the Company also recognizes the importance of urbanization and expansion of future transportation infrastructure. In order to maintain competitiveness as land prices are on the upward trend, the Company plans to secure suitable land bank for future developments.

- Visibility Enhancing product’s attractiveness with the eye-catching design.

In 2024, the Company focused on developing high-potential land plots to strengthen the proportion of single-detached houses in its portfolio. For provincial projects, the Company focuses on selecting land in provinces with strong market reception and expanding accordingly, with an emphasis on key industrial cities that serve as regional hubs. This year, the Company decided to develop a project in Rayong province to expand its market in the Eastern region, particularly in the EEC zone. Additionally, the Company also expanded into the urban condominium market for the first time.

- Pricing Strategy

As for the product pricing, the Company shall first undertake market surveys for its targeted locations which also include pricing, promotional campaigns, product ranges, project conditions, and other aspects to perform a regular and continuous assessment. This helps the team to understand the market landscape and execute the right strategies for the dynamic market climate. The pricing decision are made with a strong focus on value-for-money propositions in terms of costing, location, project design, and utility.

- Marketing and Promotion Strategy

The Company has a policy to use various media channels and a combination thereof to disseminate information on its projects to be best accessible to its clientele and general consumers. Those channels include:

- Billboard

- Radio, newspaper, and magazine

- Mobile SMS to target groups during sales promotion periods and other corporate events

- Advertisement through online media channels such as the corporate website, Facebook, Instagram, Shopee, live housing auction, other real estate websites, as well as Home+ application

- Customers’ words of mouth and recommendation from existing customers via the Company “Member Gets Member” program

The Company places great importance on advertising and public relations that are unique, modern, engaging, and easily accessible. In 2024, the Company launched the campaign 'Frasers Home: Kid Ma Krob' under the Customer Centric concept, which focuses primarily on customer needs. This includes comprehensive promotions designed to meet customer demands in every aspect.

- Cost Management Strategy

The Company manages its own construction work, by dividing the tasks into different phases such as foundation work, plaster work, constructing ensembles, flooring, and roofing, etc. The Company hires experienced contractors with expertise to undertake the construction tasks and manages the contracts by sending its own teams including engineers and foremen to monitor the construction work to ensure its standards and conformity with prescribed specifications. As the Company procures its own material supply, it is able to efficiently manage and control the construction costs. In addition, the Company established a quality development unit to conduct research and development activities for new construction methods and technical innovations to improve the Company’s scalability, cost-effectiveness, and quality excellence of its products and services to maintain a competitive advantage.

- Innovation and Technology Strategy

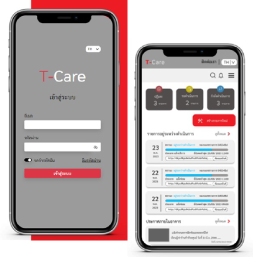

The Company is committed to enhancing the customer living experience by integrating innovation and technology. Recently, the Company launched the "FTX" application, a one-stop platform that consolidates all home-related services, including repair requests, access to exclusive privileges, as well as updates and news from the Frasers Property group. The application was designed for maximum convenience, allowing residents to easily and quickly access services and information, reflecting the Company’s dedication to creating a modern and fully equipped living environment.

Product and Service Sourcing

- Land

The Company selects land for project development in its current locations where the customer base is visible to supplant its replenishing product in the old projects. It also seeks different new locations to diversify business risks. The Company places great importance on the procurement of land for project development as a key competitive factor.

The higher costs of land that quickly escalated during the past few years have increased the Company’s development costs. Nevertheless, the Company has been trying to search for land in appropriate locations at reasonable prices, as well as maintaining its large supply of land bank which comprises vacant land in good locations suitable for various future developments in a single location. Although the lands may not be next to the BTS stations, or close to entrances and exits to the expressway, they are still easily accessible which provide convenience in commuting. The land acquisition and development process start with a market survey and research performed by its internal business team. The surveys and research cover market conditions, market competition, and consumer behavior. The findings and results will then be evaluated and used to determine relevant conceptual planning, suitable location targets, and potential project feasibilities to be submitted to the Executive Committee for considerations and decisions.

The Company adopts 3 following practices to identify and acquire potential land plots for future development:

- Real estate agents propose potential land plots to the Company, or the Company specifies preferable site locations and assigns real estate agents to proceed with land acquisition procedures.

- The Company’s representatives make direct contact with landowners to acquire target plots.

- Advertisements for purchases of potential sites are placed in print media and on the internet.

- Construction Material

The Company negotiates with construction material suppliers to obtain quality products at a fair and reasonable price through its own procurement of construction materials. Suppliers are required to give confirmation of quotes for certain materials over a six-month period. Purchases of supplies in large quantities enable the Company to well negotiate prices and be capable of controlling its construction costs. Its procurement department shall monitor the price movements of construction materials, make assessments, and calculate the estimated construction costs. In general, prices of construction materials fluctuate within the estimated ranges. In the event that the prices deviated from the estimated ranges, the Company would then seek choices of alternative materials that can be substituted in terms of usage and quality.

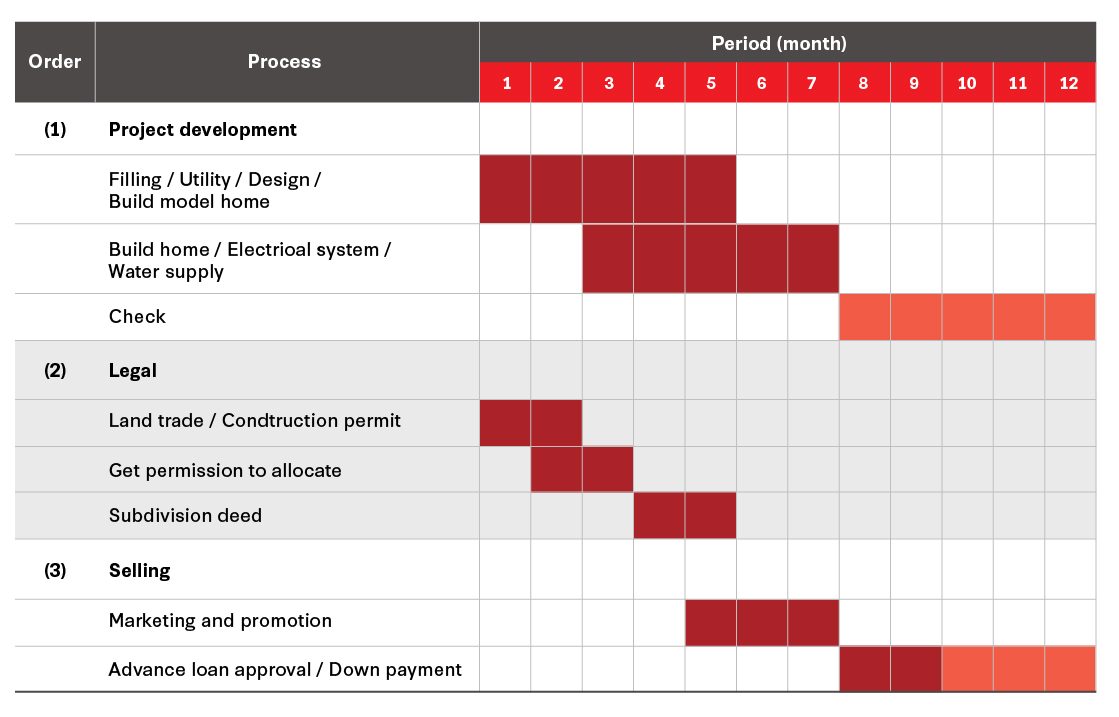

- Project Development

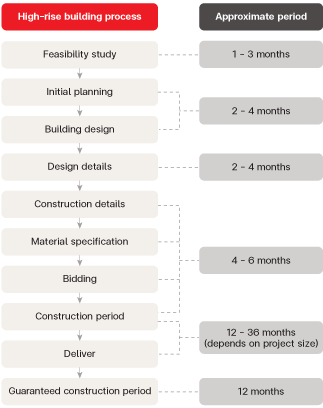

The Company shall undertake a feasibility study on the sales and development of the project. The sales department, marketing department, and business development department shall jointly perform a market survey and work together on project design and price setting. Upon the acquisition of its targeted land plot, the Company shall then start the relevant process on architectural design; either using its in-house architectural team or contracting an outside architectural firm to do the design work for its projects, its housing units, and the interior design. It shall then hire contractors for construction planning and construction work, as well as quality inspection and control. The overall process can be described as follows:

- Environmental Impacts

The Company has designed and developed proper utility systems at all residential projects to reduce an impact on the environment. For example, the Company sets up both individual wastewater treatment systems for each unit and central ones for the whole project. The quality of wastewater is also evaluated to meet the required standards before being discharged into the public sewerage system.

Moreover, the Company always makes plans prior to its application for the building construction license, to engage relevant advisors to conduct required tasks which include the application for approval of Environmental Impact Assessment Report (EIA Report) by the Office of Natural Resources and Environmental Policy and Planning. It likewise undertakes the measures as set forth in its EIA Report to reduce possible construction impacts to surrounding communities.

- Work in progress

As of 30 September 2024, the Company has recorded units sold and awaiting to be transferred in 59 projects, total of 170 units equivalent to THB 984 million.

Industrial Property Business

Business Overview

The Company provides integrated development of industrial properties with a strong portfolio of factory and warehouse of approximately 3.63 million square meters under management in key locations. Factory and warehouse offered by the Company are both in Ready-Built and Built-to-Suit type with a strong focus to expand Built-to-Suit development projects. The Company’s factories and warehouses are located in strategic locations under various industrial estates, industrial parks, industrial promotion zones, logistic parks, and free-trade zones of Thailand, as well as Indonesia and Vietnam.

Details of factories managed by the Company in 18 locations* are:

| Location | Country | Province/City | Number of Factory | |

|---|---|---|---|---|

| FPT | FTREIT | |||

| Bang Pa-In Industrial Estate | Thailand | Ayutthaya | - | 15 |

| Hi-Tech Industrial Estate | Thailand | Ayutthaya | 1 | 43 |

| Rojana Industrial Park - Ayutthaya | Thailand | Ayutthaya | 2 | 70 |

| Amata City Chonburi Industrial Estate | Thailand | Chonburi | 9 | 105 |

| Laemchabang Industrial Estate | Thailand | Chonburi | 30 | - |

| Hemaraj Chonburi Industrial Estate | Thailand | Chonburi | - | 7 |

| Amata City Rayong Industrial Estate | Thailand | Rayong | 6 | 38 |

| Bangpoo Industrial Estate | Thailand | Samutprakan | - | 13 |

| Asia Industrial Estate | Thailand | Samutprakan | 22 | 6 |

| Navanakorn Industrial Promotion Zone | Thailand | Pathumthani | - | 24 |

| Lat Krabang Industrial Estate | Thailand | Bangkok | - | 1 |

| Kabinburi Industrial Zone | Thailand | Prachinburi | 1 | 5 |

| Rojana Industrial Park - Prachinburi | Thailand | Prachinburi | 3 | 5 |

| Pinthong Industrial Estates (3 locations) | Thailand | Chonburi | - | 41 |

| Frasers Property Logistics Center (Bangplee 2) | Thailand | Samutprakan | 2 | |

| Binh Duong Industrial Park | Vietnam | Binh Duong | 23 | - |

*Note:

Excluding the areas for future development

Details of warehouses managed by the Company in 34 locations* are:

| Location | Country | Province/City | Number of Factory | |

|---|---|---|---|---|

| FPT | FTREIT | |||

| Frasers Property Logistics Park (Bangna) | Thailand | Chachoengsao | 26 | 83 |

| Bangna 2 Logistics Park | Thailand | Chachoengsao | 4 | - |

| Frasers Property Logistics Center (Laemchabang 1) | Thailand | Chonburi | - | 21 |

| Frasers Property Logistics Park (Laemchabang 2) | Thailand | Chonburi | 8 | 36 |

| Frasers Property Logistics Center (Laemchabang 3) | Thailand | Chonburi | - | 26 |

| Frasers Property Logistics Center (Wangnoi 1) | Thailand | Ayutthaya | 2 | 16 |

| Frasers Property Logistics Park (Wangnoi 2) | Thailand | Ayutthaya | 17 | 8 |

| Frasers Property Logistics Center (Eastern Seaboard 1 B) | Thailand | Rayong | 4 | 12 |

| Frasers Property Logistics Center (Eastern Seaboard 1 A) | Thailand | Chonburi | - | 7 |

| Frasers Property Logistics Center (Eastern Seaboard 2 A) | Thailand | Chonburi | - | 14 |

| Frasers Property Logistics Park (Eastern Seaboard 3) | Thailand | Chonburi | - | 8 |

| Frasers Property Logistics Park (Sriracha) | Thailand | Chonburi | - | 22 |

| Frasers Property Logistics Center (Bowin) | Thailand | Chonburi | - | 9 |

| Frasers Property Logistics Center (Phan Thong 1) | Thailand | Chonburi | 6 | 9 |

| Frasers Property Logistics Center (Bangplee 1-7) | Thailand | Samutprakan | 30 | 47 |

| Frasers Property Logistics Center (Rojana Prachinburi) | Thailand | Prachinburi | - | 8 |

| Frasers Property Logistics Center (Rojana Ayutthaya) | Thailand | Ayutthaya | 1 | 3 |

| Frasers Property Logistics Center (Amata City Chonburi) | Thailand | Chonburi | - | 7 |

| Frasers Property Logistics Park (Khonkaen) | Thailand | Khon Kaen | 14 | - |

| Frasers Property Logistics Center (Amata City Rayong) | Thailand | Rayong | 11 | - |

| Frasers Property Logistics Center (Samutsakhon) | Thailand | Samutsakhon | 2 | - |

| Frasers Property Logistics Center (Lamphun) | Thailand | Lamphun | 9 | - |

| Frasers Property Last Mile Hub (Puchao Saming Phrai) | Thailand | Samutprakan | 11 | - |

| Cold Storage (CTD)** | Thailand | Ayutthaya | - | 1 |

| Frasers Property Logistics Center (TIP9) | Thailand | Samutprakan | - | 9 |

| Karawang Warehouse | Indonesia | Karawang | 45 | - |

| Makassar Warehouse | Indonesia | Makasar | 1 | - |

| Banjarmasin Warehouse | Indonesia | Banjarmasin | 1 | - |

Note:

* Excluding the areas for future development

** Sale and leaseback agreement

Business Operation by Product types

1) Ready-Built Factory

The Company develops and manages Ready-Built Factory that meet international standards to facilitate the needs of manufacturers and companies looking to establish a business in Thailand without the burden of factory ownership. This approach helps reduce investment costs and mitigates the downside risks associated with uncertainties. The Company develops factories in various strategic locations across Thailand to accommodate manufacturers from different industries. Additionally, the Company provides a range of services related to business setup in Thailand, as over 80% of its tenants are foreign companies.

The Company considers site selection for its factories based on the demand of existing tenants as well as potential market demand in the near future. The Company also considers other factors when determining the locations including benefits from promotional zones, accessibility to international ports and airports, proximity to Bangkok as well as quality of infrastructure in industrial estates and/or industrial parks.

The Company develops factories in Export Processing Zone, General Industrial Zone, and other areas based on tenant requirements. The demand from tenants can be specific, for example manufacturers seeking factories in the Laemchabang Industrial Estate typically prefer locations near deep-sea port and within Export Processing Zone. The Company’s factories are single-storey buildings featuring mezzanine offices, proper fencing and landscaping, attached guardhouses, parking spaces and truck loading areas. The factories are built to international quality and can be customized to meet tenants’ specific requirements. Sizes range from 550 to 12,000 sqm, with typical factory sizes decreasing over the years to accommodate the rising demand from tenants with smaller-scale operations. The factories have a floor load capacity of 1 - 3 tons and are constructed using a steel portal frame, eliminating the need for structural column support and thus providing more usable spaces.

Leases between the Company and tenants are typically for a duration of three years. The Company approaches tenants for renewal as the expiration date approaches. Tenants also have an option to relocate to other factory locations offered by the Company or to rent factories of different sizes.

The Company also develops Built-to-Suit factories for tenants who want customized designs. Such tenancy is beneficial to the Company as the rental period is longer at around 5 - 10 years.

As at 30 September 2022, 30 September 2023 and 30 September 2024, the Company has occupied factory, and vacant factory as follows;

| As at 30 September 2022 | As at 30 September 2023 | As at 30 September 2024 | ||||

|---|---|---|---|---|---|---|

| Factories | Leasable Area (sq.m.) | Factories | Leasable Area (sq.m.) | Factories | Leasable Area (sq.m.) | |

| Contract | 65 | 180,519 | 68 | 189,031 | 79 | 236,500 |

| Available | 43 | 114,633 | 29 | 74,560 | 20 | 59,340 |

| Total | 108 | 295,152 | 97 | 263,591 | 99 | 295,840 |

The occupancy rate of FPT’s factory as at 30 September 2024 was 80%, higher than 72% as at 30 September 2023. Demand for factories has been driven by incentives from factory establishment in industrial estate and Eastern Economic Corridor (EEC), along with production base relocation from China which support the expansion of leased space to accommodate clients in automotive, electronics, consumer products and medical equipment industries.

Occupancy rate of factory as at 30 September 2022, 30 September 2023 and 30 September 2024 were as follows:

| As at 30 September 2022 | As at 30 September 2023 | As at 30 September 2024 | |

|---|---|---|---|

| Occupancy Rate (%) | 61 | 72 | 80 |

As at 30 September 2024, breakdown of FPT’s factory customers by industry and by country was as follows:

| Industry | % | Country/Region | % |

|---|---|---|---|

| Electronics/ Computer | 18.5 | United States of America | 17.3 |

| Auto Parts | 18.2 | China | 12.4 |

| Mold/Die/Machinery/Metal | 14.9 | Singapore | 11.6 |

| Home/office appliances | 10.6 | Sweden | 9.9 |

| Garment/Apparel | 10.4 | Japan | 8.8 |

| Logistic Service Provider | 6.5 | Germany | 7.9 |

| Packaging | 5.9 | Hong Kong | 6.9 |

| Food, Beverage and Agriculture | 4.1 | Argentina | 4.5 |

| Consumer products | 3.1 | Taiwan | 4.1 |

| Plastics | 2.1 | Vietnam | 3.8 |

| Others | 5.7 | Others | 12.8 |

| Total | 100 | Total | 100 |

Note: The above calculation is based on rental and service income as at 30 September 2024.

2) Ready-Built Warehouse

The Company is a leading developer and manager of high-quality, international standard ready-built warehouses for lease, focused on meeting the demands of logistics industry. This industry plays a vital role in the distribution of goods, raw materials, equipment parts, finished products, and other items across various regions nationwide. The logistics sector is essential for developing Thailand as a hub for ASEAN. Presently, majority of logistics providers prefer to invest in technological software and logistics system rather than developing brick-and-mortar infrastructure. This creates an ideal opportunity for the Company to lease warehouses to these logistics providers.

The Company’s warehouses are located in strategic locations that are ideal for distribution centers. The warehouses are designed to accommodate modern logistics management systems, with clear heights, wide column spans, dock levelers, and sufficient floor load capacities.

Typically, warehouse leases last around three years with an option to renew. Going forward, the Company expects increased contributions from Built-to-Suit warehouses, which generally have lease terms over three years. The average term of Built-to-Suit contracts is ten years. Additionally, the Company offers a Sale and Leaseback option for its customers.

Furthermore, the Company has developed a new concept of ready-built warehouse called “Built-to-Function”, a ready-to-use facility designed to meet the specific requirements of targeted industries. In 2024, the Company successfully delivered Built-to-Function warehouses within the Frasers Property Logistics Center Bangplee 4 and Frasers Property Last Mile Hub (Puchao Saming Phrai) projects, specifically tailored to fulfill the operational needs of clients in the logistics service provider sector.

As at 30 September 2022, 30 September 2023 and 30 September 2024, the Company has occupied warehouses and vacant warehouses as follows;

| As at 30 September 2022 | As at 30 September 2023 | As at 30 September 2024 | ||||

|---|---|---|---|---|---|---|

| Warehouses | Leasable Area (sq.m.) | Warehouses | Leasable Area (sq.m.) | Warehouses | Leasable Area (sq.m.) | |

| Contract | 143 | 825,613 | 160 | 909,034 | 163 | 942,265 |

| Available | 43 | 113,759 | 20 | 64,475 | 29 | 94,497 |

| Total | 186 | 939,372 | 180 | 973,509 | 192 | 1,036,762 |

The occupancy rate of FPT’s warehouses as at 30 September 2024 was 91%, a slight decrease from 93% as at 30 September 2023. The core customer base remains the logistics sector, which continues to expand driven by the growth of E-commerce and the relocation of production bases to enhance resilience in supply chain management. As a result, demand for rental space remains high, particularly among manufacturers of household and office products, trading companies, consumer goods, and automotive sector, especially in key areas such as Laem Chabang, Bangplee, and Wang Noi.

Occupancy rate of warehouse as at 30 September 2022, 30 September 2023 and 30 September 2024, were as follows;

| As at 30 September 2022 | As at 30 September 2023 | As at 30 September 2024 | |

|---|---|---|---|

| Occupancy Rate (%) | 88 | 93 | 91 |

As at 30 September 2024, breakdown of FPT’s warehouse customers by industry and by country was as follows:

| Industry | % | Country/Region | % |

|---|---|---|---|

| Logistics Service Provider | 35.7 | Thailand | 40 |

| Trading/Retail/Wholesale | 19.8 | France | 11.7 |

| Automotive | 11.6 | Japan | 10.8 |

| E-commerce | 10.7 | Singapore | 7.3 |

| Food, Beverage and Agriculture | 5.7 | Germany | 6.6 |

| Home/office appliances | 5 | Hong Kong | 6.2 |

| Consumer products | 4.6 | China | 4.1 |

| Drug and Medical Supplies | 4.5 | United States of America | 2.8 |

| Others | 2.4 | Others | 10.4 |

| Total | 100 | Total | 100 |

Note: The above calculation is based on rental and service income as at 30 September 2024

3) Built-to-Suit Factory and Warehouse

The Company designs and develops industrial properties tailored to meet each customer's specific requirements, focusing on the unique needs of business operators across various industries. Built-to-Suit projects optimize factory and warehouse efficiency by reducing costs and enhancing productivity in both production and storage operations. The Company has a strategic location ready to develop Built-to-Suit project within industrial estates, industrial parks, industrial promotion zones and other potential areas in Thailand. Built-to-Suit projects are leased through long-term contracts ranging from 10 to 15 years, positively impacting occupancy rates, reducing marketing expenses, and ensuring stable long-term revenue for the Company.

Over the past year, Built-to-Suit projects have garnered strong interest, with the Company successfully delivering two Built-to-Suit buildings: one in the Frasers Property Logistics Center (Bangplee 5) project and another in the Frasers Property Logistics Center (Bangplee 7) project, with a combined total area of 20,000 square meters. Further projects remain under evelopment as part of the Company’s ongoing expansion plan.

4) Investment and property management business

The Company has a policy to invest in real estate investment trust at no less than 20% of total investment units to receive recurring investment return in the form of annual dividend payment. In addition, the Company has been appointed as the property manager who manages property assets owned by FTREIT. This provides a resilience income stream to the Company in the form of property management fees.

5) Trust management business

The Company operates and manages real estate investment trust through its 70%-owned subsidiary, Frasers Property Industrial REIT Management (Thailand) Co., Ltd. or “FIRM” (formerly known as TICON Management Co., Ltd. or “TMAN”). On 28 December 2017, the Company converted three property funds; TFUND, TLOGIS and TGROWTH into Frasers Property Thailand Industrial Freehold and Leasehold REIT or “FTREIT” (previously known as TICON Freehold & Leasehold Real Estate Investment Trust or “TREIT”). In 2024, FTREIT acquired an additional 30,812 square meters of assets from FPT, making it Thailand’s largest industrial real estate investment trust with a total asset value of approximately THB 50.6 billion. FIRM, as a REIT Manager, receives management fee on an annual basis and pays dividend back to the Company.

6) Other Services

- Modification of factory/ warehouse building

The Company has an in-house design team, project development team and project management team. The Company is well positioned to assist customers in the design and modification of factor/ warehouse according to their specific requirements.

- Procurement of utilities

The Company provides assistance to customers in procuring utility services and offers additional related assistance as needed.

- Procurement of permits from the authority

The Company provides assistance to customers in obtaining the necessary permits and approvals required to commence manufacturing operations such as the Operation Permit. Moreover, the Company also assists the customers to procure work permits for foreign employees and this is deemed as one-stop service to support international customers.

- Other services

With its extensive experience in the industry and strong relationships with various business partners across different sectors, the Company is uniquely position to provide other relevant services to the customers e.g. introducing suppliers or sourcing potential employees.

Benefits and Incentives from the Board of Investment (“BOI”) for the Company and Operators in the Promotional Zone

Criteria for granting promotion incentives consists of

- Basic Incentives – Exemption of corporate income tax, Exemption of import duties on machinery, Exemption of import duties on raw materials used in R&D, Exemption of import duties on raw materials used in production for export and non-tax incentives which are classified by Activity-based Incentive and Technology-based Incentives to the company that invests in automation or robotic system or invests in automation systems that provide linkage or support to the Thai automation industry with application submitted by 31 December 2020.

- Merit-based Incentives in addition to the Basic incentives refer to the merit for competitiveness enhancements, merit on decentralization and merit for industrial area developments.

1. Benefits and incentives from the Board of Investment (BOI) for factory for rent business

Ready-built factories under selected areas of Hemaraj Chonburi Industrial Estate, Amata City Chonburi Industrial Estate, Amata City Rayong Industrial Estate, Rojana Industrial Park Prachinburi, Kabinburi Industrial Zone, Asia Industrial Estate, Rojana Industrial Park Ayutthaya, and Hi-Tech Industrial Estate were granted investment incentives from the Board of Investment, which are:

- Corporate income tax exemption for the period as listed below:

- 8 years for the projects in Amata City Rayong Industrial Estate, Rojana Industrial Park - Prachinburi and Kabinburi Industrial Zone

- 7 years for the projects in Hemaraj Chonburi Industrial Estate, Amata City Chonburi Industrial Estate, Rojana Industrial Park – Ayutthaya and Hi-Tech Industrial Estate and

- 3 years for the projects in Asia Industrial Estate

- Companies operating in the promotional areas can also use losses incurred in prior years to deduct from net profit for 5 years after tax exemption period.

- Dividend received from the business under tax exemption is also exempted from income tax throughout the period of tax incentive.

- Importing skilled laborers and/or specialists are allowed with a certain cap where those laborers can only work in the specified position.

- Permission to remit foreign currencies.

2. Benefits and incentives from the Board of Investment for warehouse for rent business

The Company’s logistic parks in Frasers Property Logistics Center (Amata City Rayong), Frasers Property Logistics Park (Wangnoi 2), Frasers Property Logistics Park (Eastern Seaboard 3), Frasers Property Logistics Park (Khonkaen), Frasers Property Logistics Park (Bangna) and Frasers Property Logistics Center (Bangplee 2) were granted investment incentives from the Board of Investment, which are:

- Corporate income tax exemption for the following period:

- 8 years for Frasers Property Logistics Center (Amata City Rayong), Frasers Property Logistics Park (Wangnoi 2), Frasers Property Logistics Park (Eastern Seaboard 3), Frasers Property Logistics Park (Khonkaen) and Frasers Property Logistics Park (Bangna)

- 3 years for warehouses in Frasers Property Logistics Center (Bangplee 2)

- Companies operating in the promotional areas can also use losses incurred in prior years to deduct from net profit for 5 years after tax exemption period.

- Dividend received from the business under tax exemption is also exempted from income tax throughout the period of tax incentive.

- Import duty is exempted for machines approved by the Board of Investment.

3. Benefits and incentives for operators in the industrial estate of the Industrial Estate Authority of Thailand (IEAT)

The Company has factories in the industrial estates which are under supervision of IEAT and hence tenants of those factories obtain certain benefits and incentives granted by IEAT as follows:

- Tax incentives (Free Trade Zone) where import duty, value added tax, and excise tax on imported machines, equipment and raw materials for manufacturing are exempted. Export duty is also exempted for export goods.

- Non-tax incentives, for instance, permission to own lands in the industrial estate under foreign entities, permission to import skilled laborers to Thailand within the permitted period, service for visa requirement and work permit, permission to remit funds outside Thailand if those funds were used for investment or relates to business outside Thailand as well as additional incentives from BOI in case of applying investment promotion.

- Other benefits such as applying for relevant permits from IEAT (normally, these permits are granted by different authorities), including land-use permit, construction permit, industrial business operation permit. IEAT also provides advisory services on documentation and legal issues to investors.

Business Innovation

As an industry leader for three decades, FPT has been recognized for its outstanding development capabilities in delivering comprehensive industrial and logistics solutions that meet all customer’s needs. With a customer-centricity approach, the Company strives to create enriching experience and enhance customer satisfaction throughout its business operations. The Company continually embraces advanced know-how and service approaches with key focus on advanced technology adoption and digitalization as a crucial part in its long-term strategy. With the rising integration of AI and IoT for industrial sector, the Company has adapted to emerging technologies to uplift its property management capabilities in offering best-in-class products and services.

The Company deployed new PropTech initiatives to upgrade the standard of property management at its logistics parks under the ‘Smart & Sustainable’ concept by introducing the AI-led monitoring system over security supervision and environmental management, in line with the national strategy to drive Thailand’s economic transformation towards Industry 4.0. The deployment of smart platform utilizes cloud-based technology to optimize AI-enabled integration with cutting-edge technologies including Computer Vision, Geofencing, Drone Inspection and Machine Learning to provide an enhanced level of security while supporting the sustainability management of properties. The AI-driven industrial & logistics platform provides high-quality monitoring system on gas emissions, energy consumption and other environmental indicators according to international sustainability benchmark. This approach fosters sustainable, secure, and environmentally friendly property management.

At present, the Platform is being used in the logistics parks under management. The Company aims to roll out the AI technology for all its logistics properties in the near future in order to deliver the global standard services and solutions, while supporting sustainability of the logistic industry through efficient pollution control technology.

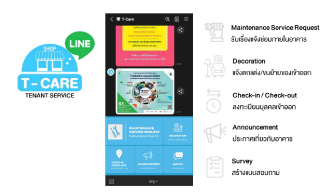

The Company has used FLEXFIX application, an integrated industrial property maintenance solution, to serve customers’ needs in maintenance services. Following a design thinking process involving relevant stakeholders, FLEXFIX has streamlined workflows by providing precise information, enabling faster responses to customer inquiries while minimizing the potential for errors. This application is also expected to promote sustainability through a reduction in paper usage. FLEXFIX is another initiative that the Company aims at enhancing customer experiences.

Market and Competition

1) Ready-built factory for rent

Ready-built factory for rent is crucial for foreign operators establishing production bases in Thailand, particularly for SMEs. These operators may choose to rent factories to reduce operational costs, expedite the start of production, and mitigate risks associated with uncertainties, especially when the factory offers comprehensive services to facilitate their operations.

Thailand serves as a strategic hub for connectivity with other countries in the CLMV region. With a skilled laborers and underlying infrastructure, Thailand attracts foreign investors including Japan, China and European countries to set up their production base. Incentives and privileges offered by the Board of Investment (BOI) and initiatives related to Eastern Economic Corridor (EEC) are part of the government’s efforts to support requirement of operators in industrial sector.

Competitors and Competitive Landscape

Developers of ready-built factory for rent can be classified into 3 categories as follows:

- Industrial estates/ industrial parks providers who also develop factories on their own industrial land e.g. Hemaraj Land and Development PLC, Amata Summit Ready Built Co., Ltd., and Pinthong Industrial Park PLC.

- Developers who develop factory on industrial land purchased or leased from the industrial estate provider such as Frasers Property (Thailand) PLC, Thai Factory Development PLC, WHA Corporation PLC.

- Other smaller developers which are not considered direct competitors of the Company as their tenants are SME businesses with a limited rental budget.

Although the overall competition of factory for rent business is quite intense, the Company remains the largest player in this market with a competitive advantage in diverse strategic locations and comprehensive services to its clients, including assistance with obtaining various permits from government agencies and securing investment promotions from the Board of Investment (BOI).

The Company’s target customers of ready-built factory for rent are part manufacturers for large businesses, particularly in automotive and electronic industries. The risk of lease termination is low for tenants in these sector, as they typically invest in facilities including machinery and production lines that are installed within the factory. Therefore, tenants are inclined to renew their leases upon expiration unless they decide to cease production or require an expansion of their leased space. The Company can accommodate these changing requirements by offering various locations and factory sizes.

In addition, the Company offers Built-to-Suit services tailored for medium to large industrial clients with a long lease terms that contribute to more stable recurring revenue over the long term.

In 2024, customer satisfaction in the industrial property business for factories was 92%, increased from 87% in 2023.

2) Ready-built warehouse for rent

Warehouse for rent plays a important role in supporting logistics and distribution business. Effective logistics management is a significant factor in attracting foreign direct investment, positioning Thailand as a regional distribution hub. Currently, warehouses for rent are mainly located in Bangkok and vicinity, distribution centers in major cities across the country, as well as strategic sites such as Laemchabang Port and Suvarnabhumi Airport.

Competitor and Competitive Landscape

Developers for ready-built warehouses for rent can be classified into 2 categories as follows:

- Developers of quality warehouse for rent e.g. Frasers Property (Thailand) PLC, WHA Corporation PLC and Hemaraj Land and Development PLC, etc.

- Other small warehouse developers who are not considered direct competitors of the Company as their tenants are SME businesses with limited rental budget, and their building structure may not require to meet international load-bearing standards.

In terms of direct competition, the Company has a competitive through its strategically diversified warehouse locations. Additionally, the Company’s land bank is well-positioned to support future Built-to-Suit developments.

Our main group of customers include:

- Logistics service providers including domestic and international leading companies with systematic management capability using software and other streamlined management system. In general, these logistics service providers do not invest in property and prefer to lease warehouses.

- Distribution center and international procurement office.

- Large producers and retailers who want to set up their distribution centers to supply products to their clients and consumers either in Bangkok or regional area.

- Import and export companies who want to use warehouses located near the airport or seaport, especially those in free zones.

- Online and E-commerce players, both from abroad and within the country.

- Other operators whose business can support distribution and logistics activities e.g. shipment

- Service provider for packing service, loading service, and added value service (quality inspection, labeling, repairing and assembling/ packing) as well as loading equipment for rent, temporary workforce service etc.

The Company employs a comprehensive marketing strategy that includes establishing direct contact with target customers and building connections with a broad network of stakeholders, such as large manufacturers, government agencies, embassies, trade offices, chambers of commerce, industrial estate owners, property agencies, and other intermediaries. In addition, the Company leverages various market communication channels and participates in seminars, trade fairs, and relevant meetings both in Thailand and internationally.

In 2024, customer satisfaction in the industrial property business for warehouses was 89%, increased from 87% in 2023.

Industry Overview

In 2Q24, the Thai economy expanded by 2.3%, accelerating from 1.6% in 1Q24, resulting in a 1.9% growth rate for the first half of the year. However, the economy remains restrained due to structural challenges in the manufacturing sector that continue to impact global competitiveness. Nevertheless, key factors supporting economic growth in 2024 include the recovery of the tourism sector, an increase in domestic consumption, public sector investments, and a gradual resurgence in exports, in line with the global trade recovery.

The rental business for factories and warehouses continues to receive government support, particularly through the Eastern Economic Corridor (EEC) project. Currently, a development plan for 2023-2027 is underway to elevate the economic and industrial zones to world-class standards, building on the 2018-2022 plan. The EEC investment plan continues to develop key infrastructure across four major projects. This investment plan seeks to leverage technology, innovation, and research and development to enhance national competitiveness and attract investment in 12 targeted industries, including electric vehicles, digital technology, medical services, and logistics, within the Bio-Circular-Green Economy (BCG) framework.

In 1Q24, the total supply of ready-built factories remained stable Y-o-Y- at 2.5 million square meters, reflecting a growth of 1.1% compared to the same period last year. The occupancy rate reached 89.0%, increased from 83.6% last year, despite a decline in the Manufacturing Production Index (MPI) and exports, reflecting the global economic slowdown. However, Thailand benefited from foreign investors relocating production bases to Thailand.

Data from the Board of Investment (BOI) for January-June 2024 indicated that there was a total of 889 foreign investment promotion applications, an 83% increase, with a total investment value of 325,736 million Baht, a 16% rise compared to the same period last year. Investments focused primarily on the electrical and electronics industries, as well as the automotive and parts sectors. The electrical and electronic sector attracted 166 projects with the highest investment value exceeding 140 billion Baht, reflecting strong growth due to the shift of electronic component manufacturing bases to Thailand to mitigates trade war risks, geopolitical tensions, and rising production costs in the West. Furthermore, large-scale projects in printed circuit boards (PCBs), semiconductors, integrated circuit testing, capacitors, solar cells, and smart appliances contribute to the rental business growth, with higher occupancy rates anticipated each quarter in 2024.

In 4Q23, the warehouse leasing business saw continued supply growth, reaching approximately 5.7 million square meters, with an occupancy rate of 84.4%. Supply is expected to grow by an additional 400,000 square meters in 2024, bringing the market’s total supply to around 6.1 million square meters. Demand is largely driven by growth in the logistics sector, especially for consumer goods and electronics, increasing the need for warehouses. The U.S.-China trade war and retaliatory policies have also accelerated the relocation of production from China, benefiting Thailand’s warehousing sector. Warehouse models like Built-to-Suit and Warehouse Farms continue to attract international investors in industries such as electric vehicles (EVs) and automotive manufacturing. The growth of e-commerce also underscores the importance of standardized distribution centers and advanced logistics systems to ensure swift, accurate order fulfillment across platforms. Thailand’s strategic location in ASEAN, central to Asia, along with robust infrastructure, skilled labor, utilities, and comprehensive logistics networks—including road, rail, air, and sea—positions the country as an ideal hub for modern logistics and distribution businesses.

Corporate Strategies

1) To be a leading provider of smart industrial platform for international industrial real estate

The Company is a leading developer of Ready-Built factories and warehouses for lease in Thailand and a top developer of Ready-Built factories and warehouses in Vietnam and Indonesia, with over 3.63 million square meters under management. The Company continues to focus on expanding Ready-Built factories and/or warehouses in strategic locations with high demand. The Company secures pre-lease contracts for future projects or projects under development to mitigate risk. The Company also plans to increase the share of Built-to-Suit factories and warehouses in its portfolio by leveraging the expertise and experience of Frasers Property Limited, its major shareholder. Built-to-Suit project are developed in close collaboration with customers, starting from the design stage to meet specific customer’s requirements, incorporating advanced technologies and innovations, and adhering to global green building standards such as LEED and EDGE. The Company has also invested alongside business partners to provide comprehensive services, including data storage solutions and office space in central business district (CBD) locations, to cater to customers in the industrial real estate sector.

2) Asset Management Strategy

The Company collaborates with Frasers Property Limited, its major shareholder, to establish a comprehensive asset management team focused on analyzing asset utilization. Some assets may be modified or adjusted, such as converting warehouses into factories or Built-to-Suit projects, or resizing them to meet market demand, or partnering with others to develop these assets into different types of real estate. The Company may also sell these assets to other operators or industrial estate developers.

This asset management strategy allows the Company to maximize the value of its existing assets while increasing revenue generation, thereby strengthening liquidity and providing investment funding for future project developments.

3) Improve competitiveness of factories and warehouses

The Company plans to improve competitiveness of its factories and warehouses. In addition to minor improvements and modifications based on customer requirements, the Company is also studying to integrate new technologies and innovations into its factories and warehouses which include automation and smart factory concept. This will also support government initiative to promote industrial sector in Thailand or Thailand 4.0 scheme.

4) Expansion to adjacent business

The Company recognizes the importance of expansion into adjacent business and is currently studying opportunities in utility business, development of industrial-led mixed-used real estate, business park, trade center and logistic park. The Company believes that these adjacent businesses will create a platform for further expansion and add value to the Company’s portfolio.

5) Expansion to other ASEAN countries

The Company has a strategy to expand its business into other ASEAN countries, particularly focusing on Indonesia and Vietnam. These countries present substantial growth potential, complemented by labor costs that are lower than those in Thailand. This has led to a strong demand for industrial properties, including factories and warehouses, where the Company is well-positioned to offer a variety of products and services. As at 30 September 2024, the warehouse occupancy rate in Indonesia has risen to approximately 95%, reflecting the increasing demand for warehouse spaces in line with economic growth. In Vietnam, the Company successfully delivered ready-built factory phase 2 with net leasable area of over 60,000 square meters, to address the high demand for factories in Vietnam. Moreover, there is a Built-to-Suit project under development for customers in e-commerce sector, which is expected to be completed by 2025.

Provision of Products and Services

1) Land acquisition

The Company has a policy to acquire suitable land plots in strategic locations with easily accessible transportation system, alongside applicable BOI privilege. The land price must be justified and the size should be adequate for future project development.

Procedure/criteria of land acquisition

- Land must be located in strategic location with convenient and easy access to public transportation, meeting customer requirements and applicable to BOI incentives.

- Fair pricing, allowing the Company to offer attractive pricing and generate a reasonable rental return.

- Project expansion and modification are considered during land selection process with flexibility to cater for future customer requirements.

2) Development team/design team and selection of contractor process

The Company has an experienced in-house project development and design team. The Company may hire external consultants when necessary to maintain business flexibility. Regarding construction material, such as steel and concrete, the Company places direct orders from several major suppliers to ensure consistent pricing and quality.

With respect to the selection of contractor, the Company has adopted clear selection criteria with guidelines on quality of products and services, establishment of good relationship with key suppliers and treatment of suppliers with fairness, transparency, and accountability. In addition, the Company also benchmarks proposed prices with reference price list to ensure that products or services are reasonably procured.

Selection Criteria of Construction Contractor

- Approved vendor list is prepared with information of qualified vendors, type of products and services. The list will be updated from time to time.

- Qualified vendors are evaluated based on profile, historical record, reputation on project delivery (punctuality and completion), expertise, well-equipped with tools, equipment and workforce, as well as after sale service.

- The Bidding Committee is set to ensure the best interest of the Company considering the reference price lists.

- Procurement is approved by the authorized person.

- Procedures to evaluate whether the purchased goods or services meet the terms and conditions.

- Clear and transparent criteria for evaluating vendor.

- New vendor is allowed to offer products and services to the Company.

Work in Progress

As at 30 September 2024, the Company has several ongoing project developments, comprising Bangna 2 Logistics Park, a joint venture with Mitsui Fudosan Group, which is located on Bangna-Trad Rd. Km.46 in the EEC area of Bangpakong Chachoengsao over a 187-rai plot of land. The project features higher quality ‘Ready-Built Warehouse’ and ‘Built-to-Suit’ options designed to accommodate modern technologies and innovations to enhance tenants’ logistics operations such as automation, and energy control system. Currently, the development of phase 2 is underway, which consists of ready-built warehouses in a Free Zone, covering approximately 25,000 square meters. This phase is designed to align with the evolving demand for warehouse facilities. The overall development plan across all phases will encompass more than 160,000 square meters of leasable space, effectively meeting the needs of clients across various sectors.

Meanwhile, the Company is developing the Frasers Property Logistics Center (Bangplee 4) project in phase 2, which will feature a total leasable area of 29,000 square meters in the strategic location of Bangplee, Samut Prakan, designed as Built-to-Function facilities.

Additionally, the Company is developing a Built-to-Suit warehouse project located in Phra Nakhon Si Ayutthaya Province, in collaboration with a retail business group, comprising a total leasable area of 89,000 square meters.

Investment in Vietnam

Business overview

Vietnam registered a rapid and continuous economic growth, with GDP projection at an average annual rate of 5.5-7.0% during 2024-2026 on the back of solid infrastructure development, export growth, and expansion in foreign investment under the effective policies to promote investments and conductive business environment, while supporting the development of small and medium-sized enterprises alongside new startups. Furthermore, Vietnam has abundant natural resources for the manufacturing and tourism sector, with over 100 million population serving as an inexpensive pool of labor supply and a market for goods and services. Vietnam geography is suitable for land transport and serves as the sea gateway for Laos and Yunnan Province of China. As a result, Vietnam has become one of the top destinations in ASEAN for relocation of the production base from China following the high growth prospect of its economy. Furthermore, Vietnam has joined various multilateral, bilateral trade agreements and Free Trade Agreements (FTA), resulting in enlarged opportunities for export sectors especially for agricultural processing, seafood processing, motorcycles-related business, construction, and tourism businesses.

With underlying supportive factors, Fraser Property Thailand capitalized on the growth opportunities in Vietnam by making a regional expansion via the Group subsidiaries. In 2021, the Company acquired a 46.8 hectares of land plot in Binh Duong City, Vietnam, with total value of USD 47.6 million or THB 1,435.2 million. In 2022, the Company acquired an additional land of 12.0 hectares. The Company targeted at the development of industrial and logistics property to support industrial estate operation and warehouse leasing business in Vietnam. Binh Duong city is regarded as the major city of Vietnam’s southern key economic zone, home to thousands of Vietnamese and multinational corporations with strategic proximity to Ho Chi Minh City (HCMC) and the seaport. The city offers logistics network and industrial promotion schemes, with approximately 76% of the 2.4 million population belongs to the labor force. In addition, Binh Duong ranked first in terms of Provincial Competitiveness Index (PCI) compared to HCMC, Dong Nai, and Ba Rai Vung Tau. Furthermore, it is considered having the largest industrial area in the southern Vietnam with highlights on high-tech manufacturing, while rental prices are 40-50% lower than HCMC.

Business operation by product types

Industrial Park in Vietnam continues to expand at a fast pace, partly supported by low labor costs and manufacturing relocation from China, which has encouraged a high level of foreign direct investment (FDI). As a result, the factories for rent and warehouses for rent business continue to grow in line with rising demand from entrepreneurs. According to House Link report, the industrial park in southern Vietnam is highly sought after and able to command higher rental rates than other regions. The Company foresees opportunities to tap on additional investments in Vietnam, with Binh Duong city being considered a well-recognized hub of industrial estate development conductive to a sustainable growth. Binh Duong Industrial Park is uniquely designed to integrate industrial activities and business operations, with a healthy and relaxing lifestyle together in an all-in-one solution under professional tenant support. In addition to infrastructure and logistic connectivity, the estate is designed to align with international standard and sustainable features to accommodate the requirements of existing industries such as the utility system, wastewater treatment, telecommunication, spine roads connected to the major roads. The Company has successfully completed the development of ready-built factories in the first phase of the project since 2022, and the second phase has also been delivered and begin operations in 2024, totaling an area of 104,798 square meters across both phases.

Market and Competition

Industry overview

The prolonged U.S.-China trade war in recent years has caused many businesses that rely on China’s production opting to relocate their manufacturing bases in order to minimize the risk of trade barriers. Vietnam has become an attractive industrial destination by corporations from all over the world, as a result, industrial estate investment has risen as it is the most significant fundamental aspect in a manufacturing facility setup. Most of the industrial parks in Vietnam are owned by the government, private entrepreneurs or a joint venture between the state and private sector; with systematic allocation of land for manufacturing operation fully equipped with utilities and facilities. It has aimed for proper urban planning to mitigate traffic congestion and environmental problems, while achieving income distribution and bringing prosperity into the region. Currently, the industrial park business in Vietnam is under a growth stage with high tendency to increase further, thanks to rising private investment and foreign direct investment (FDI) to fulfill local consumer demand in tandem, along with the expansion of export sector.

Vietnam’s economy in the first half of 2024 grew by 6.4% compared to the same period last year, accelerated by the consumer demands and government public investment. The booming of e-commerce and retail continue to experience exponential growth. Consequently, entrepreneurs are investing in factory and warehouse expansions to boost production capacity and maintain sufficient inventories to meet customer demands. Furthermore, Vietnam offers a cost advantage over its regional counterparts with lower labor, production, and utility costs, making it an attractive destination for various global companies. In the first half of 2024, foreign investment amounted to approximately USD 15.2 billion, reflecting a growth of 13.1% compared to the same period last year. This indicates significant growth opportunities for Vietnam in the future.

According to JLL, Vietnam's industrial and logistics market has seen remarkable growth, with projections indicating that investments in rental factories and warehouses in the Asia-Pacific region will rise to USD 50-60 billion in 2023-2025, doubling from USD 25-30 billion in 2020-2021. Furthermore, the industrial cities in southern Vietnam, including HCMC, Binh Duong, Dong Nai, Ba Rai Vung Tau, and Long An, continues to attract manufacturers and logistics supply chains. The occupancy rates for industrial properties and factories stood at 84% and 88% respectively. Going forward, the industrial sector holds promising prospects due to the government’s stimulus efforts aimed at enhancing inter-city connectivity through substantial infrastructure investments. Consequently, it is likely that the prices of industrial land in the southern region will continue to rise. Furthermore, developers are leveraging flexibility in land use to build hybrid models that cater to the unique requirements of different clients and emphasize sustainability. The primary target customers are multinational corporations and local companies seeking international-standard infrastructure and utilities, with a focus on industries requiring advanced manufacturing technologies, logistics, and green manufacturing industries.

Overall business strategies

- Stable and sustainable growth in the Vietnam market

The Company aims to ride on the high growth trajectory of the rental market for factories and warehouses by offering a full range of services and products. With the knowhow and experience of Frasers Property Group in the Vietnamese market, the Company continues to leverage on the Group’s capabilities and focuses on built-to-suit developments to meet the specific demand of potential customers.

- Expansion into adjacent businesses to enhance real estate service solutions

The Company continues to proactively seek investment opportunities in adjacent business platforms, ensuring alignment with the core strategies of Frasers Property Group, its major shareholder.

Provision of Products or Services

To establish an industrial estate in Vietnam, the Ministry of Planning and Investment, along with relevant agencies, are responsible for submission of a master plan to obtain the Prime Minister’s approval. The authorized master plan will serve as a blueprint to setup a new industrial estate and develop surrounding supportive infrastructure, which the Provincial People’s Committee will decide in the detailed implementation plan. Under Vietnamese law, the government allocates the land for entities or individuals to utilize for investment, construction, and infrastructure management for industrial estates. The land allocation is carried out by the Provincial People’s Committee in collaboration with the regulatory authorities overseeing the industrial zones within each respective province.

According to Vietnamese laws, non-Vietnamese are not allowed to own land; hence most of the industrial estate developers will enter into a land lease agreement with the government and pay an annual rental or one-time lump-sum upon the signed agreement. Currently, the Company has been granted approval to develop 58.8 hectares of land, equivalent to more than 230,000 square meters of leasable area.

Work in progress

The project development in the Binh Duong Industrial Park has successfully completed both Phase 1 and 2, with a total leasable area of over 104,798 square meters of ready-built factories. Currently, there is a Built-to-Suit project under development, covering approximately 30,000 square meters, which is expected to be completed by 2025.

Investment in Indonesia

Business overview

The Company continuously seeks opportunities for investment expansion to achieve sustainable and robust growth, focusing on enhancing its comprehensive real estate portfolio in international markets to better meet the diverse needs of clients. The Company has invested in three key logistics center projects providing modern warehouse services located in Karawang, Makassar, and Banjarmasin, Indonesia, by acquiring a 75% stake in PT SLP Surya Ticon Internusa and a 100% stake in PT Surya Internusa Timur. This investment has contributed to an increase of over 150,000 square meters to the international portfolio. Additionally, this year, the Company further expanded its investments in Indonesia by increasing its stake in PT SLP Surya Ticon Internusa to 100%. The Company believe that this strategic investment will enhance its stability through a steady stream of rental income from a portfolio of leading brand clients.

Business operation by product types

The three modern projects in Karawang, Makassar and Banjarmasin appeal to logistics operators who require high efficiencies in storage and distribution. Situated in the prime location connected to Jakarta and surrounded by first-rate industrial estates, FPT’s logistics center in Karawang spans across 128,566 square meters of net leasable area. The factories and warehouses certified by international standards are well received by the tenants and users from various industries including automotive manufacturing, consumer products and technologies.

The two Built-to-Suit warehouses were developed in Makassar and Banjarmasin for a global FMCG company, Unilever, occupying a net leasable area of 11,358 square meters and 9,750 respectively. The large-scale distribution centers streamline Unilever's logistics operations with efficiency in large inventory management and prompt product distribution. One of the key strengths of the Makassar warehouse is its location. Having over 1.5 million population, Makassar, the capital city of South Sulawesi, is ranked the fifth most populous city in Indonesia. Owing to the proximity of only 5 kilometers from the nearest airport, the warehouse becomes the highly sought-after logistics hub. Meanwhile, the warehouse in Banjarmasin enjoys a strategic location in an industrial area easily accessed via seaports and airports.

Market and Competition

Industry overview

In 2Q24, the Indonesian economy expanded by approximately 5.0% compared to the same period last year, driven by government spending. Domestic consumption continues to grow, indicating that purchasing power within the country remains strong. However, the overall export sector experienced a slight contraction in the first half of the year compared to the same period last year. Nonetheless, exports are expected to rebound in the second half of the year, supported by anticipated improvements in the manufacturing sector.

Indonesia’s e-commerce market has a total value of USD 52.9 billion in 2023 and is expected to rise to USD 86.8 billion in 2028, supported by the change of consumer behavior from in-store to online after COVID-19 pandemic. Indonesia is a promising e-commerce market in Asia-Pacific, with several local and global players competing in the market. Rising internet penetration and increasing digitalization have been driving e-commerce growth. Indonesia is expected to account for 50% of all e-commerce transactions in Southeast Asia by 2025. The growth of e-commerce and logistics business drives the demand of industrial properties that meet international quality standards and attract customers who want to expand business in Indonesia.

As at 30 September 2024, the occupancy rate stands at 95% with a strong average occupancy rate of 94% throughout the year. Furthermore, the Company intends to build international-standard warehouses to accommodate multinational companies. In addition, the Company is prepared to develop the Built-to-Suit project to meet the specialized tenant’s demand. The Company believes that there are still numerous opportunities in Indonesia.

Overall business strategies

- Stable and sustainable growth in the Indonesia market

The Company aims to ride on the high growth trajectory of warehouses for rent market by offering a full range of services and products. With Frasers Property Group knowhow and experience in the Thailand and Vietnam market, the Company continues to leverage on the Group’s capabilities and gearing towards a built-to-suit development to meet the specific demand of potential customers.

- Expansion into adjacent businesses to enhance real estate service solutions

The Company continues to proactively seek out investment opportunities in adjacent business platforms in line with the core strategies of Frasers Property Group, which is a major shareholder of the Company.

Provision of Products or Services

1) Land acquisition